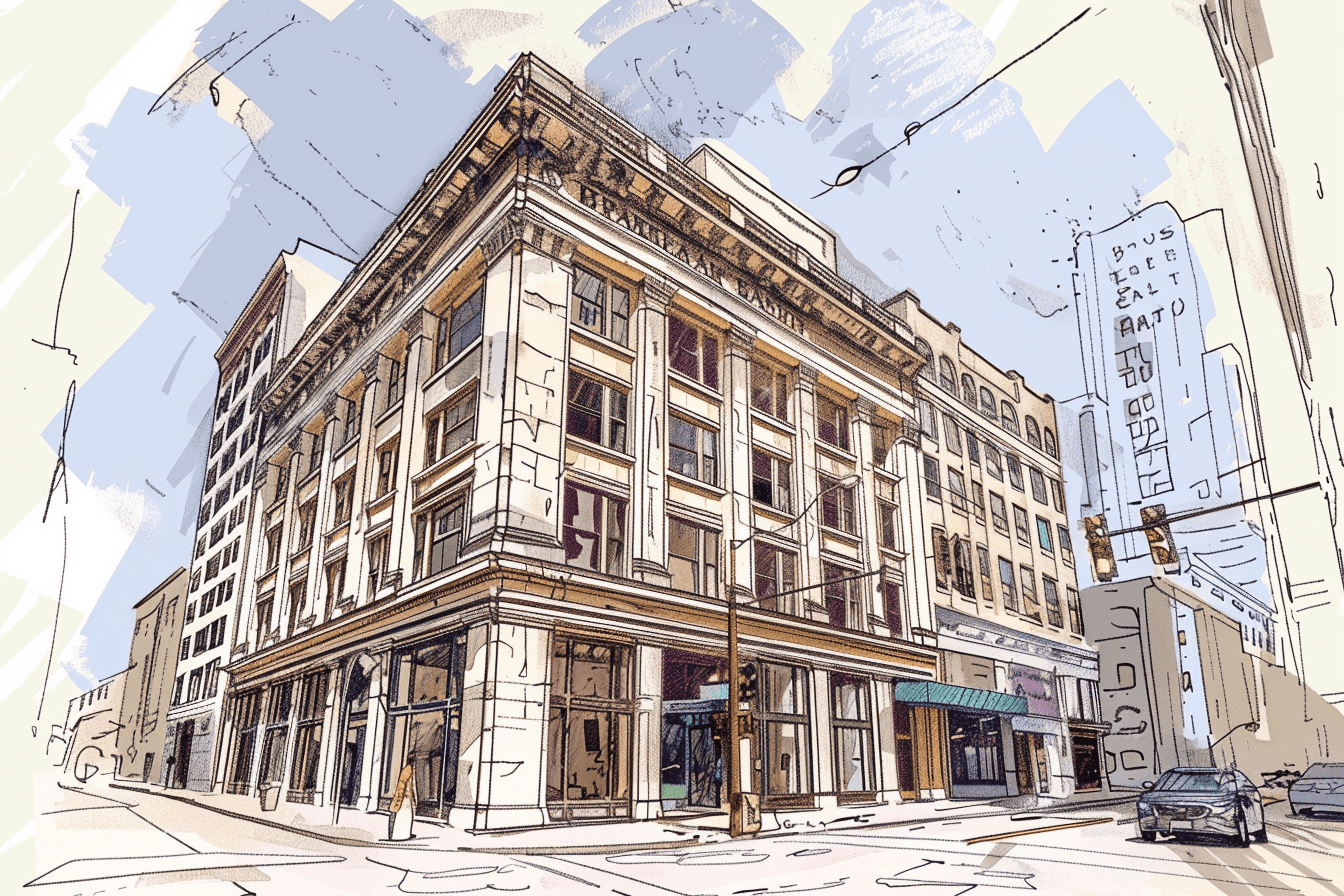

A creditor considering a fraudulent transfer action against a debtor’s transfer of real estate has to consider where to file the lawsuit. The issue becomes interesting when the debtor, the debtor’s property, and the recipient (transferee) of the property are each located in a different state, or if all in Florida, different Florida counties.

An attorney wrote to me last month asking my opinion about where his client should file the following fraudulent transfer action. The writer’s client had a money judgment against an individual domiciled in Florida. Within one year of the judgment, the debtor conveyed to his father, a New York resident, title to the debtor’s vacation home located in North Carolina. The attorney was considering in which state he should try to effect the reversal of the conveyance as a fraudulent transfer .

Probably the creditor should file suit in North Carolina after he first domesticates the Florida judgment in North Carolina. Only the North Carolina courts have jurisdiction to change the title of North Carolina property. Although the creditor already has jurisdiction over the debtor in Florida, I do not think a Florida court could order transfer of out-of-state real estate. There are several Florida court cases that hold a Florida court must of jurisdiction over both the debtor and the debtor’s assets to order transfer or affect title to the asset.

People Also Read…

Sign up for the latest articles.

Get notified by email when we publish a new article about asset protection law and strategies.