Business asset protection involves structuring property in a way that makes it more difficult for a judgment creditor to collect on a money judgment against the business or business owner.

A Florida business entity is a legally recognized organization formed to conduct commercial or professional activities. The main business entities include corporations, LLCs, and limited partnerships. Florida statutes establish rules for each of these entities and give each type of entity unique legal characteristics, formalities of operation, and tax attributes.

Understanding Asset Protection for Small Business Owners

Most owners of small businesses conduct their business in a corporation, limited liability company (LLC), or partnership. The owner’s selection of a business entity depends upon many factors, such as whether the business is owned within a family, whether there are passive investors, the expectation of public ownership, and tax planning.

To protect the owner’s personal assets from business liabilities, it makes little difference which of these three entities the owner chooses to operate the business. Each business entity provides a “corporate shield” that protects its individual owners from business liabilities and claims. If the business breaches an obligation or causes injury to a third party, only the business itself (not the owner of the business) is legally responsible.

Professionals who conduct their business through a professional corporation (PA) or professional limited liability company (PLLC) are not shielded from personal liability for professional negligence. Any claim not covered by malpractice insurance may be enforced against the professional’s personal assets. A professional corporation or PLLC does protect each professional member from personal liability for damages assessed against any other shareholders or members.

Florida Sole Proprietorship

Some businesses start out as sole proprietorships. In Florida, a sole proprietorship is an unincorporated business that is not established as a separate legal entity. There is no distinction, and no shield, between the business and its owner.

A sole proprietorship can only have one owner—hence the name. Taxes on any income of the business is paid personally by the sole owner. In sole proprietorships, the individual owner has unlimited liability for debts incurred by the business.

Because a sole proprietorship does not insulate oneself from liabilities stemming from the business activity, most business owners operate their business through a separate legal entity instead of as a sole proprietorship.

We help protect your assets from creditors.

We offer customized advice for clients throughout Florida. Get answers for your specific situation by phone or Zoom.

Best Types of Business Entities in Florida

Conducting business in a corporation, LLC, or limited partnership has advantages compared to a sole proprietorship. Privacy is one advantage. Each of these three business entities is legally a separate “person.” They have their own Federal Tax Identification Number that is separate from the owner’s social security number. Real estate, bank accounts, and other business interests can all be owned in the entity name. The identity of corporate shareholders, LLC members, and limited partners is not required in any public filing with the Florida Secretary of State. Therefore, government-required reports can be designed so that the business’s equity owners’ names are not accessible on any public record.

Privacy is not a feature of all businesses. For example, publicly traded companies must disclose the names of principal shareholders in regular reports to the Securities and Exchange Commission and Florida regulatory agencies.

Protecting the Assets of Small Businesses

Asset protection of a business entity is different than asset protection for individuals. Individual debtors residing in Florida may protect their assets under the exemptions made part of Florida’s constitution and statutes. The individual Florida debtor can exempt their primary residence, many financial assets, and in many cases, salary and marital property from creditor judgment.

A significant portion of people seeking asset protection advice are business owners who have acquired wealth through entrepreneurial business ventures. Often, the business owner’s potential creditors have a claim against the business as well as the individual owner who may have signed personal guarantees of business debt or guarantees to vendors. A creditor’s successful attack upon the business’s assets can deprive the owner of current income and future wealth.

Florida’s individual asset protection exemptions do not apply to business entities. Florida law gives business entities no asset exemptions. With no exemptions applicable, all business assets are at risk if a creditor obtains a judgment against a business entity.

The recording of a judgment will become an automatic lien on all real estate held in a business name. A creditor can garnish all business bank accounts and other debts owed to the business, including accounts receivable from individuals or third parties such as insurance companies. A judgment creditor can even levy upon the business’s leases, thereby depriving the business of access to leased offices, facilities, and vehicles. Essential intangible property, including goodwill, client lists, patents, software, or website domains are exposed to a judgment creditor’s execution and levy.

Business asset protection is the arrangement of business assets that makes it difficult for a judgment creditor to collect judgments from the assets. Effective asset protection tools are more complex than the protection of the business owner’s assets. Any tools must be implemented early and thoughtfully. Also, business asset protection may have income tax consequences, and asset protection tools may have different tax effects on different owners of the same business. Business planning should involve an asset protection attorney, the business’s general attorney, and the business’s tax accountant

Special Purpose Business Entities

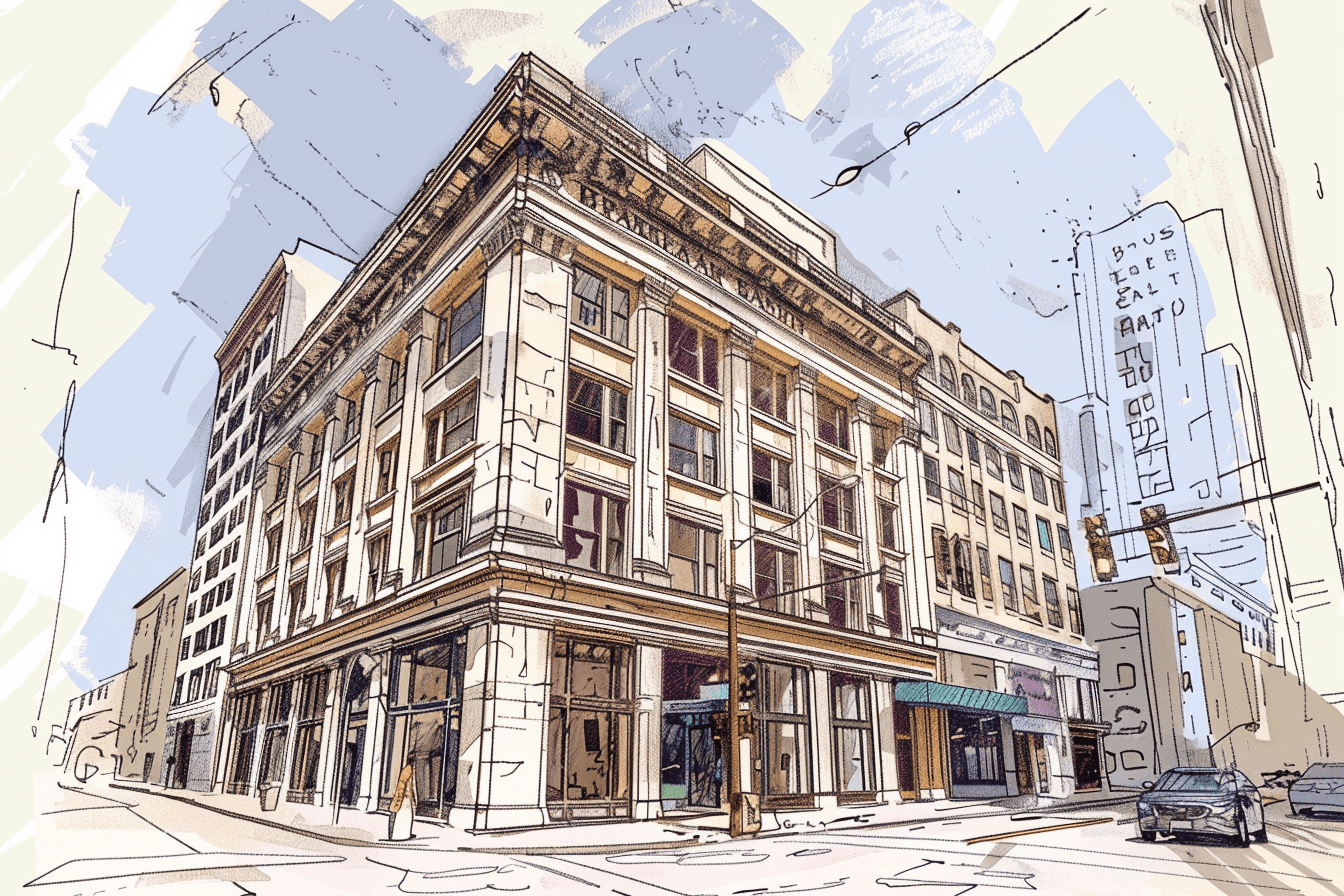

The core of any successful business is its ongoing operations, including its manufacturing of goods or provision of services to its customers, financial dealings with lenders and suppliers, and marketing to prospective customers. Most potential legal liability that a business encounters is associated with its core business. Lawsuits arise from financial transactions or from business interactions with third parties, such as customers, clients, or suppliers.

Business assets are vulnerable if they are owned by the same legal entity that operates the core business because a judgment against that business entity will threaten the core assets and jeopardize business operations. Business asset protection starts by separating the ownership of essential business assets from core business operations. An operating business can use essential assets even if the legal titles to the same assets are owned by a different legal entity (such as a different LLC or corporation).

The non-core entities which own business assets are often referred to as “special purpose entities” (“SPE”). Their special purpose is to own, hold, and maintain assets that are essential to an operating business. An SPE can have legal title to real estate, intellectual property, equipment, or even accounts receivable. The SPE may lease or license its assets to the core business, and the core business pays the SPE for asset use in periodic payments of rent or license fees. These lease or license payments are tax-deductible by the core business entity and are income to the SPE. A judgment against the core operating business should not endanger the assets owned by these special purpose entities.

To be effective, a business plan needs to separate business assets from the core business early in its business history and before threatened litigation. A business’s assignment of its assets to a separate entity can be attacked as a fraudulent transfer if it appears that the business planning was undertaken primarily to place the business assets outside the reach of creditors. Also, transfers of assets from a core business to an SPE after a business has grown may have adverse tax consequences. If the business has depreciated the asset, or if the asset has appreciated (such as land), then the transfer to an SPE may accelerate taxation of the amount by which the asset’s value at the time of transfer exceeds its adjusted tax basis.

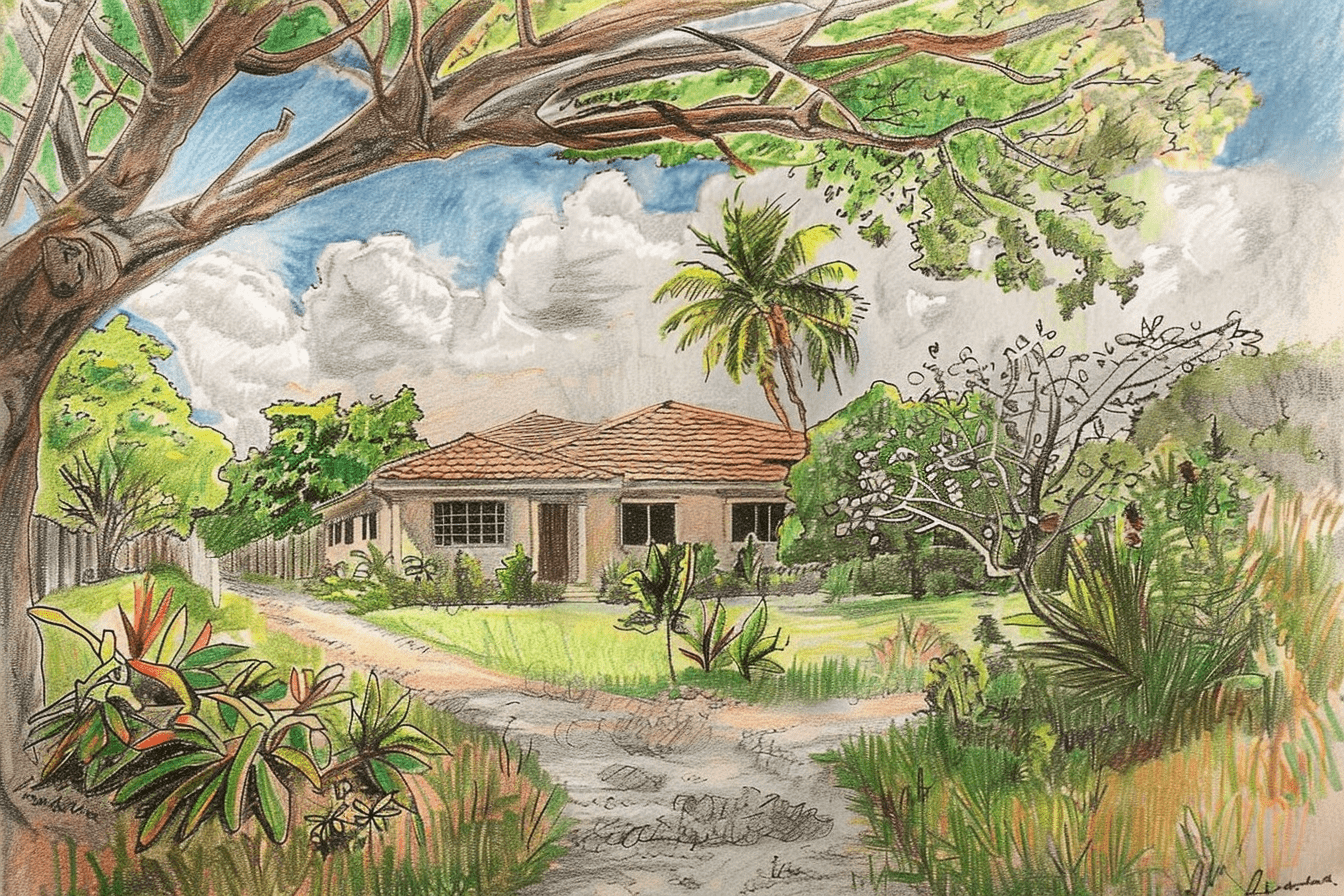

Real Estate

Many small businesses own commercial real estate that the businesses use as offices or warehouses. A recorded judgment against the business will immediately and automatically become a lien on the business’s real estate.

A business can set up an SPE such as an LLC or partnership to take legal title to business real estate at the time of purchase. The SPE can be owned by the same individuals who own the operating business, although it is usually preferable to add additional owners such as family members or trusts. The business leases the real estate from the SPE, and it pays the SPE market rent. The SPE will flow through to the individual business owner’s depreciation and other tax losses associated with the real estate. The SPE may record a security interest encumbering other core business assets to secure its right to lease payments.

Intellectual Property

Small business owners often underestimate the value of their intellectual property, especially their website domain and website content. A business’s intellectual property may have little value to a third party or creditor, but the same intellectual property is essential to the debtor’s business. The debtor’s business could be forced to shut down its website if a judgment creditor levied upon a web domain or other intellectual property including patents and trademarks.

Cash

Some business owners keep large amounts of cash in business checking accounts. A creditor with a judgment against a business will move quickly to garnish all business financial accounts. Bank garnishments are the easiest way for a creditor to execute a money judgment against a business. A business concerned about a potential lawsuit should keep just enough cash on hand to pay immediate obligations such as employee salaries and vendor payments. Surplus cash can be distributed to business owners in the normal course of business. It is important to demonstrate a history of distributed profits or salary to owners because there will be fraudulent transfer issues if a business makes a one-time distribution to owners of a large amount of accumulated business cash in the face of litigation.

Alternatively, if a business needs to retain a cash surplus, it should not hold the cash at the same bank where it maintains its operating accounts. A judgment creditor will usually know the debtor business’s primary bank from which the business writes most checks, and the creditor will quickly garnish all accounts at that bank. Creditors will not immediately know about business accounts at different banks (or accounts in different states) that hold business cash not used in the normal course of business. However, a judgment creditor will eventually discover all cash accounts through post-judgment discovery. Additionally, some banks are very difficult to garnish under applicable law, even if the creditor knows of accounts at such banks.

Office Furniture and Special Use Equipment

Normal office furniture, including desks, chairs, computers, and tenant improvements, have little value and are easily replaceable. Small-size technology equipment is portable. Most businesses do not set up a Special Purpose Entity to own only office furniture and equipment. Some aggressive judgment creditors may try to identify and then levy on general office equipment to harass the business debtor. The debtor may have to “buy back” general equipment in lieu of replacing the office equipment by lease or purchase through an SPE.

Some businesses have valuable specialized equipment that is essential to their core business services. For example, levy and sale of a business debtor’s large or specialized industrial equipment used in a manufacturing process or a commercial service can often produce significant money for a judgment creditor. A business should own valuable equipment in an SPE and lease the equipment from the SPE at market value. Fraudulent transfer and tax issues discussed above for other assets classes are similarly relevant to special business equipment.

FAQs About Asset Protection for Small Businesses

How can small businesses protect assets?

A small business can protect its assets by using various asset protection techniques, including custom operating agreements and other governing documents, friendly liens on real estate and equipment, and strategic management of liquidity.

Does an LLC provide asset protection?

A multi-member LLC can protect personal assets. A creditor of the individual owner cannot force the sale of an LLC membership interest in a multi-member LLC nor get the assets owned by the LLC.

Which is the safest business structure to protect your personal assets?

The most common small business entity is a limited liability company. LLCs are more flexible and offer better protection than corporations. There are significant administrative and tax differences between LLCs and corporations.

Should I put all my assets in an LLC?

No, most people should not put all assets into an LLC. A single-member LLC in most states does not protect assets from creditors of the individual owner. In addition, some assets are better owned by individuals for protection purposes than by a business.

People Also Read…

Sign up for the latest articles.

Get notified by email when we publish a new article about asset protection law and strategies.